The Truth About Tariffs and Construction Costs

We are often asked, “Are the recent tariffs impacting construction costs?” In short, not as much as people think. We’ve been closely monitoring both the market and our subcontractor base to anticipate significant swings in material pricing. So far, however, the reaction has been relatively modest.

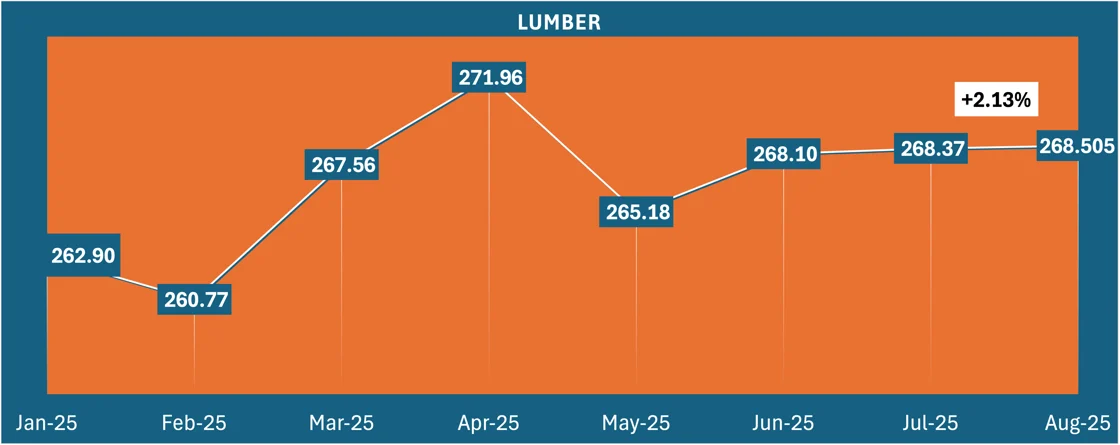

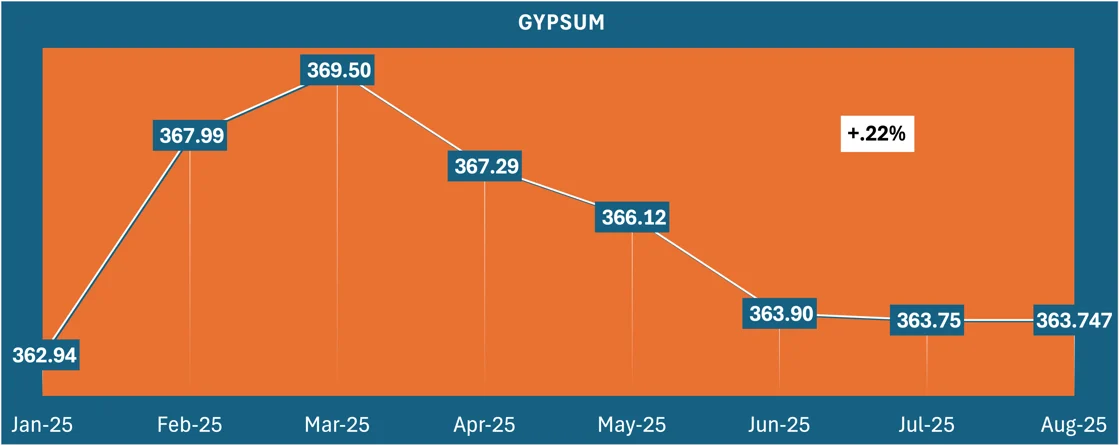

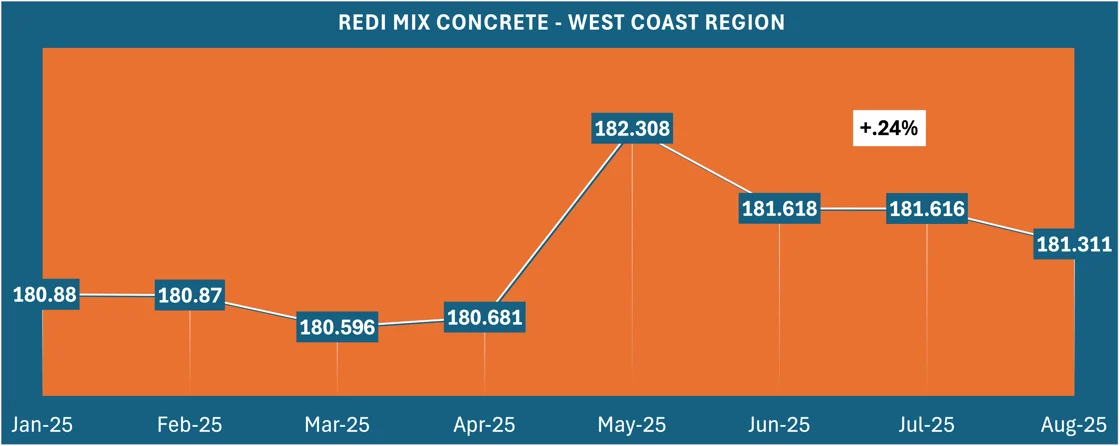

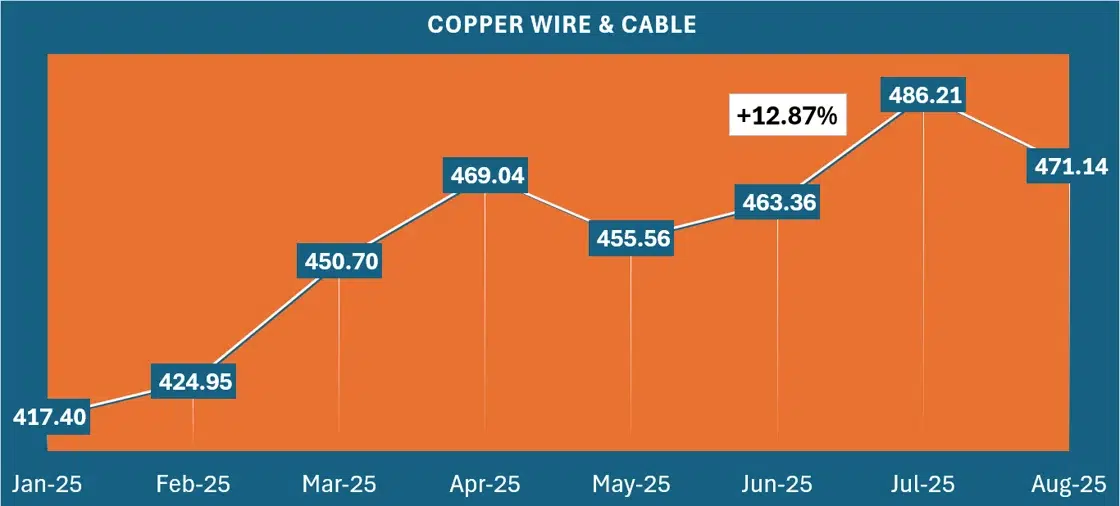

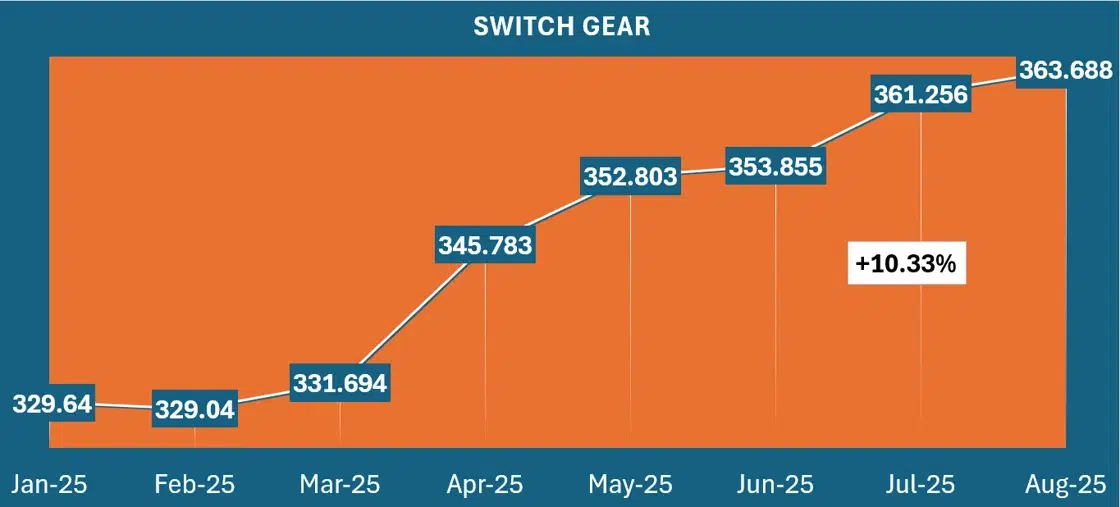

The graphs below track this year’s Producer Price Index (PPI) for several key components used in our projects. (Note: the PPI is a relative index, not a direct price—it measures changes in the selling prices received by domestic producers over time. These figures do not translate directly to costs per ton, board foot, or other unit measures.)

Lumber

Lumber Tariff timeline:

- 3/5/25 – The 25% duty on imports of lumber from Canada went into effect.

- 4/5/25 – New general baseline reciprocal tariffs (10%) under a broader tariff policy started. Lumber manufactured in North America (softwood, etc.) was excluded from this round.

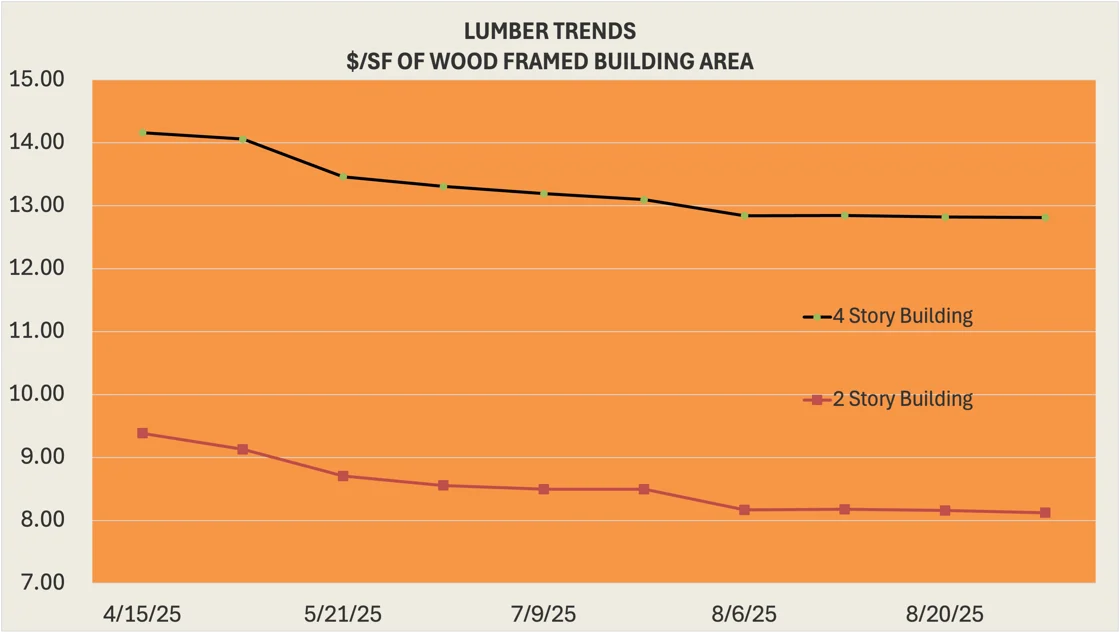

To provide a more tangible perspective, here is a graph showing lumber costs per square foot for both a four-story and a two-story building prototype:

Steel

Steel Tariff timeline:

- 2/10/25 – President Trump signed proclamations to reimpose 25% tariffs on all steel and aluminum imports.

- 5/30/25 – Tariffs on steel and aluminum imports were doubled from 25% to 50%.

- 6/23/25 – Expansion of steel tariffs (50%) to include household appliances (items with steel/aluminum derivatives) such as washing machines, refrigerators.

Gypsum

Gypsum Tariff timeline:

- 3/4/25 – The U.S. government imposed 25% tariffs on gypsum wallboard products imported from Mexico and Canada.

Redi Mix Concrete

Redi Mix Tariff timeline:

- 4/2/25 – The U.S. government imposed a 25% tariff on cement imports from Mexico and Canada.

Copper and Switch Gear

Copper/Switchgear Tariff timeline:

- 8/1/2025 – 50% tariff takes effect on imported copper. The tariffs apply to semi-finished copper products (like wire, tubing, sheets, rods) and intensive copper derivative products (pipe fittings, electrical components, etc.). Refined copper ore, concentrates and scrap copper are exempt.

Labor

At Sun Country Builders, we are fortunately not experiencing shortages in the skilled trades needed to deliver our projects. We currently have about 90 employees in the field across various trades (many of them long-team members). We’ve had no difficulty adding qualified workers when we’ve needed to ramp up.

In Summary

The market’s reaction to tariffs has been mixed but generally modest despite forecasts. Lumber costs per square foot are actually trending slightly downward since tariffs were implemented. The most measurable price increases to date have been on copper wire, cable and materials containing copper. And over the last three months, steel has seen a smaller but considerable jump in price. Relatively unchanged: the PPI for gypsum and redi mix concrete.

As we all know, market conditions can change quickly. We are keeping an eye on construction costs and will keep you informed as updates become available.

Data Source: Federal Reserve Bank of St. Louis